Learn how to write an investment contract with our comprehensive guide. Get step-by-step instructions and discover essential clauses to create clear and legally binding agreements.

Investment contracts are essential documents that outline the terms and conditions of an investment agreement between parties. Whether you are an investor looking to fund a startup or a business seeking capital, a well-drafted investment contract can protect your interests and clarify expectations. This article will guide you through the process of writing an investment contract, covering key components, legal considerations, and best practices.

Understanding the Basics of an Investment Contract

What is an Investment Contract?

An investment contract is a legal agreement between an investor and a business or individual that outlines the terms of an investment. It typically includes details about the amount of money being invested, the ownership stake or equity being offered, the rights and obligations of each party, and the expected return on investment (ROI).

Why is an Investment Contract Important?

An investment contract serves several critical purposes:

- Clarity: It clearly defines the terms of the investment, reducing the likelihood of misunderstandings.

- Protection: It protects the rights of both the investor and the business, ensuring that both parties are aware of their obligations.

- Legal Recourse: In case of disputes, a well-drafted contract provides a legal basis for resolution.

Key Components of an Investment Contract

When writing an investment contract, it is essential to include specific components to ensure that the document is comprehensive and legally binding.

1. Parties Involved

Begin the contract by clearly identifying the parties involved. Include the full legal names, addresses, and roles of each party (e.g., « Investor » and « Company »). This section establishes who is entering into the agreement.

2. Investment Amount

Specify the total amount of money being invested. This section should detail how the funds will be used and any conditions attached to the investment. For example, if the investment is intended for specific projects or operational costs, outline those details.

3. Ownership Stake

Define the ownership stake or equity that the investor will receive in return for their investment. This could be expressed as a percentage of the company or a specific number of shares. Be clear about how this stake will be calculated and any conditions that may affect it.

4. Rights and Obligations

Outline the rights and obligations of both parties. This section should cover:

- Investor Rights: Voting rights, access to financial information, and any other rights the investor may have.

- Company Obligations: Responsibilities of the company, including reporting requirements and how the funds will be managed.

5. Return on Investment (ROI)

Detail the expected return on investment. This could include dividends, interest payments, or a share of profits. Specify how and when these returns will be distributed to the investor.

6. Duration of the Agreement

Indicate the duration of the investment contract. Specify whether it is a short-term or long-term investment and any conditions under which the contract may be terminated.

7. Exit Strategy

Include provisions for an exit strategy. This section should outline how the investor can exit the investment, whether through a buyback option, sale of shares, or other means. Clearly define the process and any conditions that must be met.

8. Confidentiality Clause

Incorporate a confidentiality clause to protect sensitive information shared between the parties. This clause should specify what information is considered confidential and the obligations of both parties to maintain confidentiality.

9. Dispute Resolution

Outline the process for resolving disputes. This could include mediation, arbitration, or litigation. Specify the jurisdiction and governing law that will apply to the contract.

10. Signatures

Conclude the contract with a section for signatures. Both parties should sign and date the agreement to indicate their acceptance of the terms.

Legal Considerations

1. Consult a Legal Professional

Before finalizing an investment contract, it is advisable to consult with a legal professional. An attorney with experience in investment agreements can help ensure that the contract complies with applicable laws and regulations.

2. Compliance with Securities Laws

If the investment involves the sale of securities, ensure compliance with relevant securities laws. This may include filing requirements and disclosures to protect investors.

3. Clarity and Precision

Use clear and precise language throughout the contract. Avoid ambiguous terms that could lead to misunderstandings. The goal is to create a document that is easy to read and understand.

Best Practices for Writing an Investment Contract

1. Be Transparent

Transparency is crucial in investment agreements. Both parties should be open about their expectations, financial situations, and any potential risks associated with the investment.

2. Use Plain Language

While legal terminology may be necessary, strive to use plain language wherever possible. This makes the contract more accessible to all parties involved.

3. Review and Revise

After drafting the contract, take the time to review and revise it. Consider seeking feedback from trusted advisors or colleagues to ensure that the document is comprehensive and clear.

4. Keep Records

Maintain copies of all versions of the investment contract, including drafts and final versions. This documentation can be valuable in case of disputes or misunderstandings.

5. Update as Necessary

As circumstances change, be prepared to update the investment contract. This may include changes in ownership stakes, investment amounts, or other terms. Ensure that all parties agree to any modifications in writing.

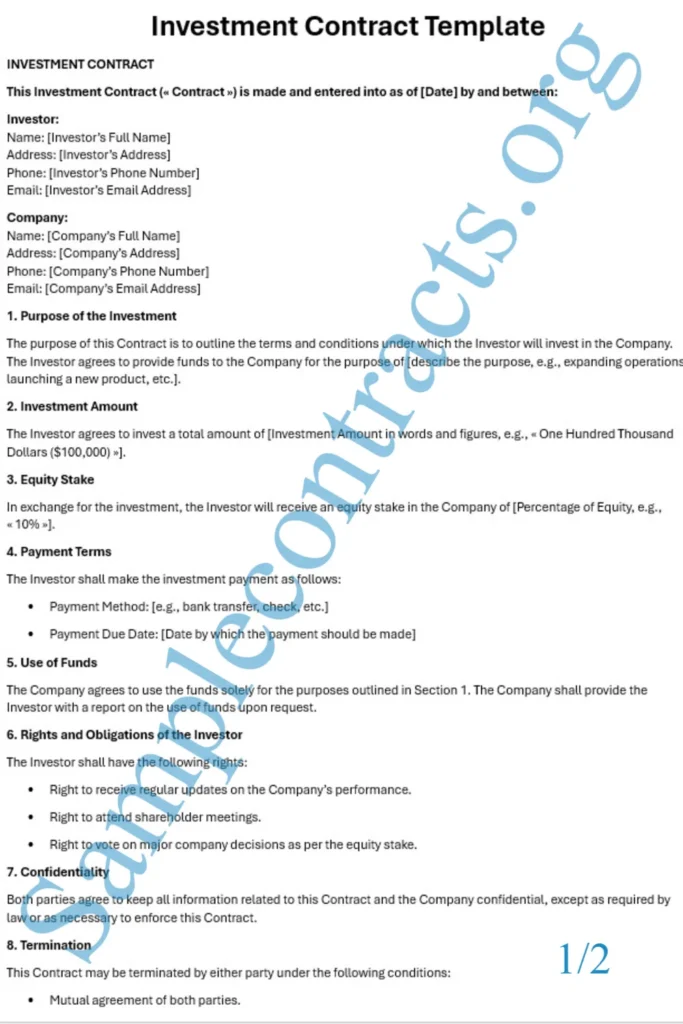

Investment Contract Template

INVESTMENT CONTRACT

This Investment Contract (« Contract ») is made and entered into as of [Date] by and between:

Investor:

Name: [Investor’s Full Name]

Address: [Investor’s Address]

Phone: [Investor’s Phone Number]

Email: [Investor’s Email Address]

Company:

Name: [Company’s Full Name]

Address: [Company’s Address]

Phone: [Company’s Phone Number]

Email: [Company’s Email Address]

1. Purpose of the Investment

The purpose of this Contract is to outline the terms and conditions under which the Investor will invest in the Company. The Investor agrees to provide funds to the Company for the purpose of [describe the purpose, e.g., expanding operations, launching a new product, etc.].

2. Investment Amount

The Investor agrees to invest a total amount of [Investment Amount in words and figures, e.g., « One Hundred Thousand Dollars ($100,000) »].

3. Equity Stake

In exchange for the investment, the Investor will receive an equity stake in the Company of [Percentage of Equity, e.g., « 10% »].

4. Payment Terms

The Investor shall make the investment payment as follows:

- Payment Method: [e.g., bank transfer, check, etc.]

- Payment Due Date: [Date by which the payment should be made]

5. Use of Funds

The Company agrees to use the funds solely for the purposes outlined in Section 1. The Company shall provide the Investor with a report on the use of funds upon request.

6. Rights and Obligations of the Investor

The Investor shall have the following rights:

- Right to receive regular updates on the Company’s performance.

- Right to attend shareholder meetings.

- Right to vote on major company decisions as per the equity stake.

7. Confidentiality

Both parties agree to keep all information related to this Contract and the Company confidential, except as required by law or as necessary to enforce this Contract.

8. Termination

This Contract may be terminated by either party under the following conditions:

- Mutual agreement of both parties.

- Breach of contract by either party, provided that the breaching party has not cured the breach within [number of days, e.g., « 30 days »] after receiving written notice.

9. Governing Law

This Contract shall be governed by and construed in accordance with the laws of [State/Country].

10. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Investment Contract as of the date first above written.

Investor:

[Investor’s Full Name]

Date: ________________________

Company:

[Authorized Signatory’s Name]

[Title]

Date: ________________________

Notes:

- Customization: Be sure to customize the template with specific details relevant to the investment, including the names of the parties, investment amount, and any other pertinent information.

- Legal Review: It is advisable to have the contract reviewed by a legal professional to ensure compliance with local laws and regulations.

- Clarity: Ensure that all terms are clear and unambiguous to avoid potential disputes in the future.

Conclusion

Writing an investment contract is a critical step in formalizing an investment agreement. By including key components, understanding legal considerations, and following best practices, you can create a comprehensive and effective contract that protects the interests of all parties involved. Remember, a well-drafted investment contract not only clarifies expectations but also serves as a foundation for a successful partnership. Whether you are an investor or a business seeking funding, taking the time to craft a solid investment contract is an investment in your future success.