Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Explore a wide variety of free, professionally drafted contract templates. Find and customize agreements for personal, business, and legal purposes. Simplify your contract creation process with our comprehensive, easy-to-use templates.

Explore a wide variety of free, professionally drafted contract templates. Find and customize agreements for personal, business, and legal purposes. Simplify your contract creation process with our comprehensive, easy-to-use templates.

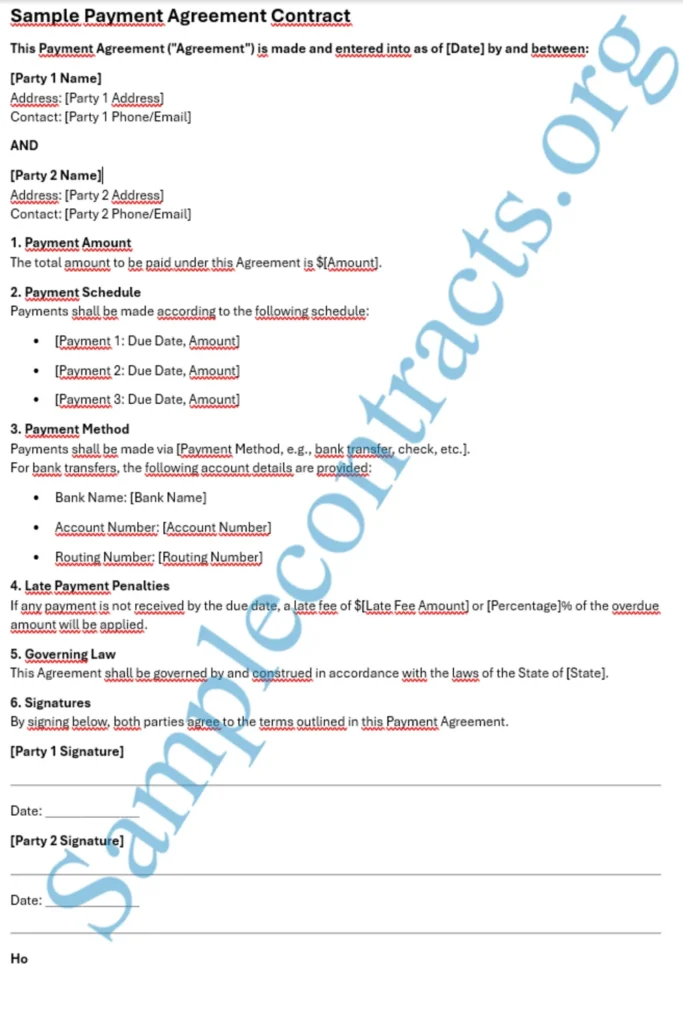

Legal document of payment terms agreement: Download this template to ensure clear and binding payment terms between parties, including detailed payment amounts, schedules, and signatures.

Sample payment agreement contract: Download this template to formalize your payment agreements, including detailed sections on amounts, deadlines, and signatures.

In the world of business and personal transactions, a payment agreement contract serves as a crucial document that outlines the terms and conditions under which payments will be made. This article will provide a comprehensive overview of payment agreements, including their importance, key components, and a sample template in PDF format. Whether you are a freelancer, a business owner, or an individual entering into a financial arrangement, understanding payment agreements is essential for protecting your interests.

A payment agreement is a legally binding document that specifies the terms of payment between two parties. It outlines the amount to be paid, the payment schedule, the method of payment, and any penalties for late payments. Payment agreements can be used in various contexts, including loans, services rendered, and sales transactions.

A well-drafted payment agreement should include the following key components:

Clearly identify the parties involved in the agreement, including their full names, addresses, and contact information.

Specify the total amount to be paid, including any applicable taxes or fees. If the payment is for services rendered, detail the services provided.

Outline the payment schedule, including due dates and the frequency of payments (e.g., weekly, monthly, or upon completion of services).

Indicate the method of payment, such as cash, check, bank transfer, or credit card. Include any necessary details, such as bank account information for transfers.

Include provisions for late payments, such as interest rates or fees that will be applied if payments are not made on time.

Specify the jurisdiction whose laws will govern the agreement. This is particularly important in case of disputes.

Both parties should sign and date the agreement to indicate their acceptance of the terms.

Below is a sample payment agreement contract that can be used as a template. This sample can be downloaded in PDF format for convenience.

Payment Agreement Contract

This Payment Agreement (« Agreement ») is made and entered into as of [Date] by and between:

[Party 1 Name]

Address: [Party 1 Address]

Contact: [Party 1 Phone/Email]

AND

[Party 2 Name]

Address: [Party 2 Address]

Contact: [Party 2 Phone/Email]

1. Payment Amount

The total amount to be paid under this Agreement is $[Amount].

2. Payment Schedule

Payments shall be made according to the following schedule:

3. Payment Method

Payments shall be made via [Payment Method, e.g., bank transfer, check, etc.].

For bank transfers, the following account details are provided:

4. Late Payment Penalties

If any payment is not received by the due date, a late fee of $[Late Fee Amount] or [Percentage]% of the overdue amount will be applied.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State].

6. Signatures

By signing below, both parties agree to the terms outlined in this Payment Agreement.

[Party 1 Signature]

Date: _______________

[Party 2 Signature]

Date: _______________

When using the sample payment agreement, it is essential to customize it to fit your specific situation. Fill in the blanks with the relevant information, and ensure that all terms are clear and agreed upon by both parties.

Before finalizing the agreement, discuss the terms with the other party. Ensure that both parties understand and agree to the payment amount, schedule, and method.

Once both parties are satisfied with the terms, sign the agreement. It is advisable to have a witness or notary public present during the signing for added legal protection.

Both parties should keep a copy of the signed agreement for their records. This will serve as a reference in case of any disputes or misunderstandings.

Ensure that all terms are clearly defined. Ambiguities can lead to disputes down the line.

Including late payment penalties is crucial for encouraging timely payments. Without them, there may be little incentive for the other party to pay on time.

Both parties must sign the agreement for it to be legally binding. A verbal agreement is not sufficient.

Be aware of local laws that may affect the terms of your payment agreement. Consult with a legal professional if necessary.

A payment agreement contract is an essential tool for ensuring that financial transactions are conducted smoothly and fairly. By clearly outlining the terms of payment, both parties can protect their interests and avoid potential disputes. The sample payment agreement provided in this article can serve as a valuable resource for anyone looking to create their own payment agreement. Remember to customize the template to fit your specific needs and consult with a legal professional if you have any questions or concerns.

For your convenience, you can download the sample payment agreement contract in PDF format using the link below:

This article provides a comprehensive overview of payment agreements, their importance, and a sample contract template. By understanding the key components and best practices, you can create effective payment agreements that protect your interests in any financial transaction.

Share via: